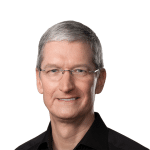

Ireland has officially closed its lengthy tax dispute with Apple, reclaiming more than $15 billion from an escrow account. This marks the conclusion of one of the most significant corporate tax cases in European Union history.

The Irish Department of Finance confirmed in May 2025 that the funds will move to the state treasury. Apple initially deposited the money in 2018 after the European Commission ruled that Ireland granted illegal tax advantages.

How the Case Began

In 2016, the European Commission found that Apple paid an effective tax rate as low as 0.005% on profits routed through Irish subsidiaries. It ordered the company to repay €13.1 billion ($14.2 billion) plus interest, bringing the total to about $15.5 billion.

Apple and Ireland appealed, arguing that the company had complied with Irish and international tax laws. While the EU General Court sided with them in 2020, the European Court of Justice overturned that decision in 2024, forcing Ireland to claim the funds.

What Happens to the Money

The windfall will boost Ireland’s public finances, though officials say spending will be gradual to avoid economic disruption. The government also reaffirmed its commitment to international tax reforms, including the OECD’s 15% global minimum tax.

Apple maintains that it paid all taxes owed and highlighted that most profits were later taxed in the United States.

Wider Implications for Tech and Tax Policy

This case is the EU’s largest corporate tax recovery and signals stricter enforcement of state aid rules. Analysts believe it will deter member states from offering preferential tax deals to multinational corporations.

Ireland, long known for its low corporate tax rates, now faces the challenge of balancing competitiveness with compliance under global tax reform efforts.