Apple’s Tap to Pay on iPhone has officially arrived in five additional European countries, marking another step in the tech giant’s mission to make contactless payments more accessible. The feature, which launched in the United States in May 2022, allows vendors to accept payments directly on their iPhones without needing external hardware such as card readers. This advancement is especially valuable for small businesses that want a simple, cost-effective way to accept payments.

Countries and Payment Partners

The latest rollout includes Estonia, Latvia, Lithuania, Monaco, and Norway. Each country is partnering with select financial institutions and payment platforms. In Estonia and Lithuania, SumUp and Revolut are supporting the service, while Latvia relies on SumUp alone. Monaco brings Adyen and BNP Paribas into the mix, and Norway is backed by a wide range of providers, including Adyen, Nexi, PayPal, Stripe, SumUp, Surfboard Payments, and Viva.com.

Secure and Seamless Transactions

Tap to Pay on iPhone integrates seamlessly with Apple Pay and supports major credit and debit cards such as Visa, Mastercard, and American Express. In Norway, it also works with Surfboard Payments, broadening its usability. Apple emphasizes that the system ensures privacy and security while delivering a smooth checkout experience.

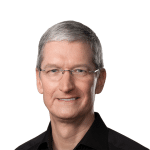

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, highlighted this vision when the feature launched in the U.S.: “Tap to Pay on iPhone will provide businesses with a secure, private, and easy way to accept contactless payments and unlock new checkout experiences using the power, security, and convenience of iPhone.”

A Growing Global Footprint

With this expansion, Tap to Pay on iPhone is now available in 43 regions worldwide. Earlier in May 2025, Apple extended the service to eight other EU countries, demonstrating its commitment to strengthening its presence across Europe.

The continued growth of Tap to Pay on iPhone reflects the rising demand for cashless solutions. As more consumers embrace digital wallets and contactless cards, Apple’s technology positions itself as a key player in shaping the future of in-person payments.