Investment firm Evercore has raised Apple’s stock target to $300, reflecting confidence in the company’s growth potential despite recent revenue challenges. The increase comes after Apple’s latest earnings report, which showed steady demand for the iPhone 17 lineup and optimism surrounding the upcoming Apple Intelligence rollout.

This marks the third price adjustment in less than two months. Evercore previously raised Apple’s target from $250 to $260 in early September, then to $290 later that month. The firm’s latest note highlights strong iPhone sales momentum and expectations of improvement in supply constraints that limited previous quarters.

iPhone Demand Fuels Growth Forecasts

Evercore’s analysts believe that demand continues to outpace supply for Apple’s flagship phones. While Apple reported a slight miss in iPhone revenue, the firm attributes it to temporary production limitations rather than waning interest.

Apple projects that supply will stabilize by early 2026, potentially leading to double-digit sales growth next quarter. This optimism, combined with the company’s record-setting revenue performance in other product segments, strengthens Evercore’s bullish stance.

Anticipation Builds for Apple Intelligence

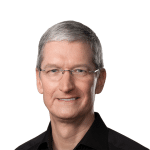

During Apple’s latest earnings call, CEO Tim Cook reaffirmed that Apple Intelligence — the company’s suite of AI-powered features — remains on track for a 2026 launch. Although Apple did not confirm a specific release date, Evercore anticipates a spring 2026 debut, aligning with Apple’s usual product cycle.

Analysts expect these AI tools to play a crucial role in Apple’s ecosystem expansion, further driving hardware sales and long-term service revenue.

Navigating Tariffs and Market Pressures

Despite the positive outlook, Evercore acknowledges external challenges. The report notes that U.S. tariffs introduced under President Trump’s administration could cost Apple up to $3.3 billion by early 2026. However, analysts maintain that Apple’s brand strength, innovation pipeline, and consumer loyalty position it well to weather short-term financial headwinds.