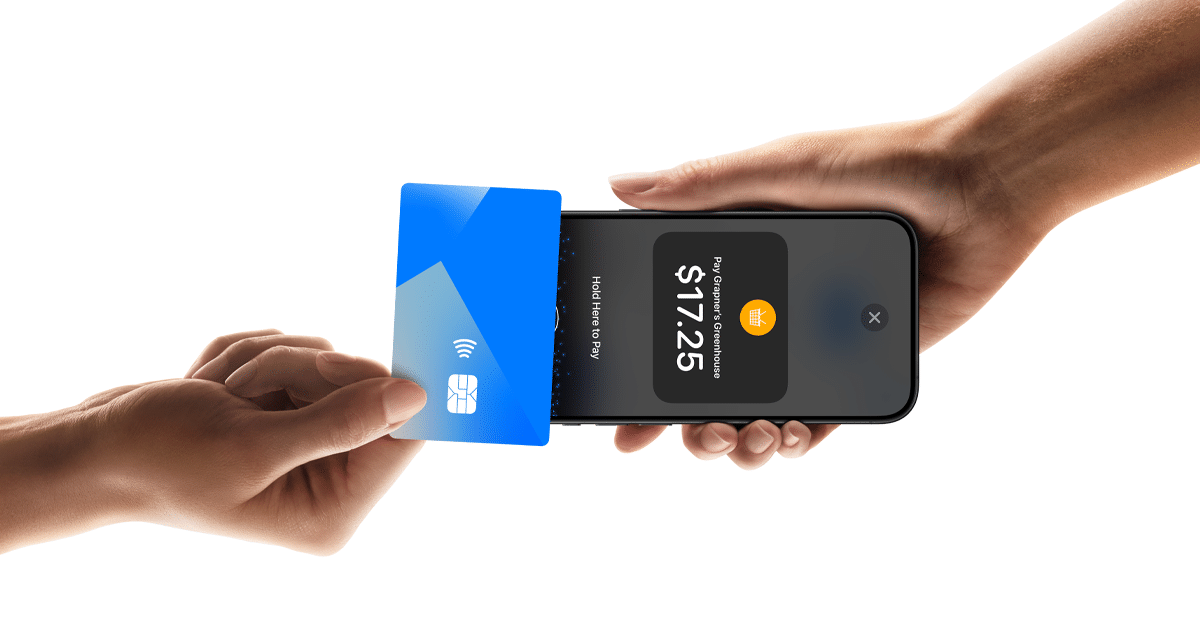

Apple has brought Tap to Pay on iPhone to Hong Kong, marking an important step in the service’s global rollout. The feature lets merchants accept contactless payments directly on an iPhone, removing the need for extra hardware.

The service first appeared in the United States in 2022. Since then, Apple has slowly added more regions. With Hong Kong now included, the company continues to broaden its reach across Asia.

How Businesses and Customers Benefit

Tap to Pay on iPhone gives small and large businesses an easy way to handle transactions. Vendors only need an iPhone 11 or newer, along with the latest supported version of iOS. Once set up, the device becomes a secure payment terminal.

Customers can pay with:

- iPhone

- Android smartphones

- Any contactless credit or debit card

This flexibility helps businesses serve more people without investing in extra payment readers.

Supported Payment Platforms in Hong Kong

At launch, several payment platforms already work with Tap to Pay on iPhone in Hong Kong:

- Adyen

- Global Payments

- KPay

- SoePay

Apple notes that more providers will join later, although it has not given a timeline.

A Meaningful Move in the Region

Hong Kong’s introduction of the feature highlights Apple’s growing focus on Asia. It also stands out because Hong Kong is the first Special Administrative Region of China to offer the service. Taiwan gained the feature in 2023, but its political status remains debated.

Apple Emphasizes Security and Ease of Use

Apple continues to promote the safety and privacy of the service. The company states that Tap to Pay on iPhone uses the device’s built-in security and never stores card numbers. Merchants can start accepting payments within minutes, which makes the system attractive for new or mobile businesses.