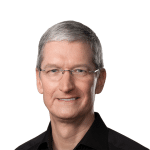

Tim Cook, CEO of Apple, has significantly increased his personal stake in Nike, drawing attention across Wall Street. According to regulatory filings, Cook recently purchased 50,000 additional Nike shares, nearly doubling his holdings and bringing their total value to more than $6 million.

The move stands out at a time when Nike is attempting to recover from a challenging year in the stock market.

Details Behind the Share Purchase

Cook disclosed the purchase in a Form 4 filing, which showed he bought the shares at an average price of $58.97 each. The transaction totaled roughly $2.95 million. After the purchase, Cook now owns about 105,000 Nike shares.

Following news of the investment, Nike’s stock rose above $60 per share. While that increase does not erase losses from earlier in the year, it gave the stock a noticeable boost and improved short-term sentiment among investors.

A Long-Standing Relationship With Nike

Cook’s connection to Nike goes far beyond a single stock purchase. He has served on Nike’s board of directors since 2005 and has advised the company on strategy, retail design, and digital expansion. Over the years, Cook has also encouraged Nike to refocus on its core products instead of oversaturating the market.

Additionally, Cook has played a role in Nike’s digital efforts in China, a key growth region for the brand. His close involvement makes the investment more than a financial decision. Many analysts view it as a personal vote of confidence.

Nike’s Turnaround Efforts

Nike has faced a difficult 2025, with its stock losing about 24 percent over the year. In response, the company brought back veteran executive Elliott Hill as CEO to guide a turnaround.

Cook reportedly supported leadership changes and management adjustments. As a result, his increased investment is widely seen as an endorsement of Hill’s strategy and Nike’s recovery plan.

Why Wall Street Is Paying Attention

High-profile insider buying often sends a strong message to markets. In this case, Cook’s action suggests belief in Nike’s long-term prospects, even amid short-term struggles.

While one purchase alone cannot reverse broader market trends, it does signal confidence from someone deeply familiar with Nike’s operations. As 2025 closes, Cook’s move offers Nike a positive note—and gives investors a reason to watch closely what comes next.